Let me tell you a secret from the other side of the desk.

I’ve been working in banking since 2010. I’ve sat across from thousands of people—from anxious fresh graduates to seasoned millionaires. Over the last 15 years, I’ve noticed a disturbing pattern. The people who come in with the most detailed, color-coded, 20-page “5-Year Financial Plans” are often the ones who panic the hardest when life throws a curveball.

Why? Because life doesn’t care about your Excel spreadsheet.

The market crashes. A pandemic happens. AI reshapes your industry. You get a surprise medical bill. When you have a rigid “plan,” any deviation feels like a failure. It’s fragile.

On the flip side, the wealthiest, calmest clients I manage don’t have “plans.” They have systems.

We are in late 2025. The era of static budgeting and rigid forecasting is over. “Financial Planning” as we knew it is dead. If you want to survive the volatility of the modern economy and thrive in the age of AI, you don’t need a map; you need a GPS that updates in real-time.

You need a Financial Life Operating System (OS).

Here is why your old plan is failing you, and how to build a dynamic, AI-powered OS that builds wealth on autopilot.

The Problem: Why “Static Planning” is a Trap

Imagine trying to drive from New York to Los Angeles using a paper map printed in 1990. That is what a traditional financial plan is. It assumes the road conditions will never change.

As a banker, I see this “Static Trap” destroy wealth every day:

- The Inflation Lag: You planned to save $500 a month, but inflation ate your purchasing power. Your plan didn’t adjust; you just felt poorer.

- Decision Fatigue: A plan requires you to make active choices constantly. “Should I transfer this money?” “Can I afford this dinner?” Willpower is a finite resource.

- The Guilt Cycle: When you break the plan (and you will), you feel guilty. Guilt leads to avoidance. Avoidance leads to financial chaos.

The Banker’s Take: A plan relies on you being disciplined 24/7. A system relies on automation being perfect 24/7. Guess which one wins?

The Solution: What is a Financial Life OS?

A Financial Life OS is not a document; it is an ecosystem of automated rules, AI tools, and asset flows that you design once and tweak occasionally.

Think of your phone’s operating system (iOS or Android). It manages your battery, your apps, and your security in the background. You don’t manually tell your phone to “cool down” or “allocate RAM.” It just does it.

Your money should work the same way. A robust Financial OS has three layers:

- The Kernel (Automation & Flow)

- The Intelligence (AI & Analytics)

- The Growth Engine (Investments)

Let’s build your OS, layer by layer.

Layer 1: The Kernel – Automating the “Boring” Stuff

In banking, we call this “Cash Flow Waterfall.” It’s the plumbing of your financial life. The goal here is zero-touch money management.

Most people get their paycheck, pay bills, spend randomly, and try to save what’s left. This is broken. As I detailed in my previous guide on ending paycheck-to-paycheck living, you need a system where every dollar has a job before it even hits your checking account.

The Setup:

- The Hub: Use a central checking account as your “Router.”

- The Spokes: Set up automatic transfers for the day after payday.

- 20% to Investing: Straight to your brokerage account (more on this in Layer 3).

- 10% to Safety: Into a High-Yield Savings Account (HYSA).

- Fixed Costs: Auto-pay for rent/mortgage and utilities.

- The “Guilt-Free” Remainder: Whatever is left in the “Hub” is yours to burn.

Why this works: You aren’t “saving money”; the system is saving it for you. This creates the exact kind of financial flexibility that allows you to make bold career moves without stress.

Layer 2: The Intelligence – Using AI as Your CFO

Here is where 2025 tech changes the game. In the old days, you’d hire a CFO or spend Sunday nights analyzing receipts. Now, AI does it.

However, a word of caution: As I warned in The AI Money Trap, you should never let AI make decisions for you. Instead, use it as a ruthless analyst to audit your behavior.

The “Forensic Audit” Protocol:

Forget generic budgeting apps. We are talking about using Generative AI to find leaks.

I recently uploaded an anonymized bank statement to ChatGPT and asked it to act as a “Forensic Accountant.” The result? It found $200/month in wasted subscriptions and hidden fees in seconds.

If you want to try this yourself, I shared the exact copy-paste prompt I used to find $2,400 a year in a recent post.

The “OS” Mindset: Your Financial OS should include a quarterly “AI Audit.” It’s not about restricting yourself; it’s about optimizing the system code to remove bugs (waste).

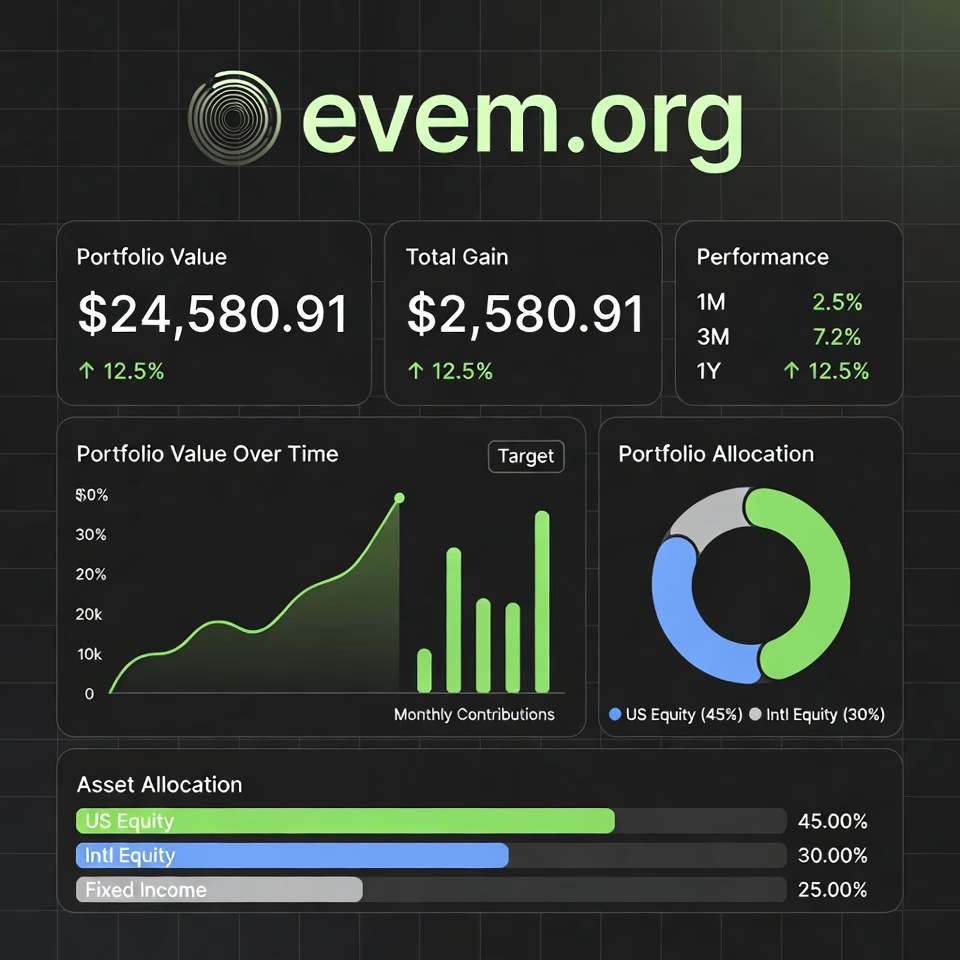

Layer 3: The Growth Engine – The “Set and Forget” Portfolio

As a banker, I can tell you that complexity is the enemy of execution.

I’ve seen clients with 30 different stocks, 4 crypto wallets, and an angel investment in a friend’s café. They think they are “diversified.” I see a nightmare of fees and stress. Especially if you are prone to anxiety, checking these accounts daily can lead to panic selling.

The most efficient Financial OS uses a “Boglehead” approach turbo-charged by modern automation.

- Index Funds are the CPU: Low-cost, broad market ETFs should be the core processor of your wealth. If you are new to this, read my guide on ETF investing for beginners to understand why this is safer than picking individual stocks.

- Automated Dollar Cost Averaging (DCA): Set your brokerage to buy these funds automatically every month. This removes the fear of investing at the “wrong” time.

- The Debt Firewall: Before you pour fuel into this engine, ensure you aren’t leaking oil. If you have credit card debt with 20%+ interest, the math says you must kill that first. Check my 2026 Profit & Loss Analysis on Debt vs. Investing to see exactly how to balance this.

Quote to live by: “The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett. Your OS supplies the patience that your biological brain lacks.

How to Install Your “Financial OS” This Weekend

You don’t need to be a tech wizard. You just need to stop being a “planner” and start being an “architect.”

- Map the Flow: Draw a diagram of where your money comes in and where it goes.

- Automate the Transfer: Log into your bank portal and set up the recurring transfers.

- Boost Your Income: A system is only as good as the fuel you put in it. Once your OS is built, shift your focus to increasing your inputs. Use AI tools to negotiate your bills or even negotiate a higher salary to supercharge the system.

- Test the System: For one month, don’t manually pay a single bill. Watch the system work.

The Banker’s Verdict

Financial freedom isn’t about being smarter than the market. It isn’t about predicting the next Bitcoin. It’s about removing the biggest risk to your wealth: You.

We are emotional, tired, and biased creatures. We panic-sell at the bottom and FOMO-buy at the top.

A Financial Life OS protects you from yourself. It operates on cold, hard logic and compound interest, running silently in the background while you enjoy your life.

Stop planning. Start building.

Ready to upgrade your wallet?

We are developing a “Financial OS Template for 2026”—a plug-and-play Notion dashboard integrated with AI prompts to automate your wealth. Join our email list below to get early access before we launch it to the public.