Let me tell you about Maria.

Maria is a talented project manager. She’s smart, she works hard, and her friends see her as the “responsible one.” But every month, like clockwork, a familiar dread creeps in about a week before payday. She opens her banking app, swipes through the transactions, and does the painful mental math: “Okay, if I cancel my weekend plans and eat nothing but leftovers, I should be… fine.”

She’s running on a financial hamster wheel. The paycheck lands, the bills get paid, and the rest just seems to evaporate. Despite a good salary, she feels perpetually broke. This is one of the classic 5 Money Mistakes Keeping You Broke, and it’s incredibly common.

If Maria’s story feels a little too real, it’s because millions of us are trapped in the same cycle. It’s not a moral failing or a lack of discipline. It’s a system problem. We’re taught to work hard for our money, but no one teaches us how to build a system that makes our money work for us.

In my years as a banker, I’ve seen that the clients who build real wealth aren’t the ones with the most complex spreadsheets or the strictest budgets. They’re the ones who build simple, automated systems that run in the background. Today, I’m giving you that exact 3-step playbook.

Confessions of a Banker: The Myth of the “Perfect Budget”

I’ve been a banker since 2010. I’ve had a front-row seat to the post-2008 recovery, the rise of fintech apps, and the post-2020 inflationary rollercoaster. The fundamental principle of “spend less than you earn” hasn’t changed in all that time, but the strategy to achieve it in an age of digital banking and constant temptation absolutely has.

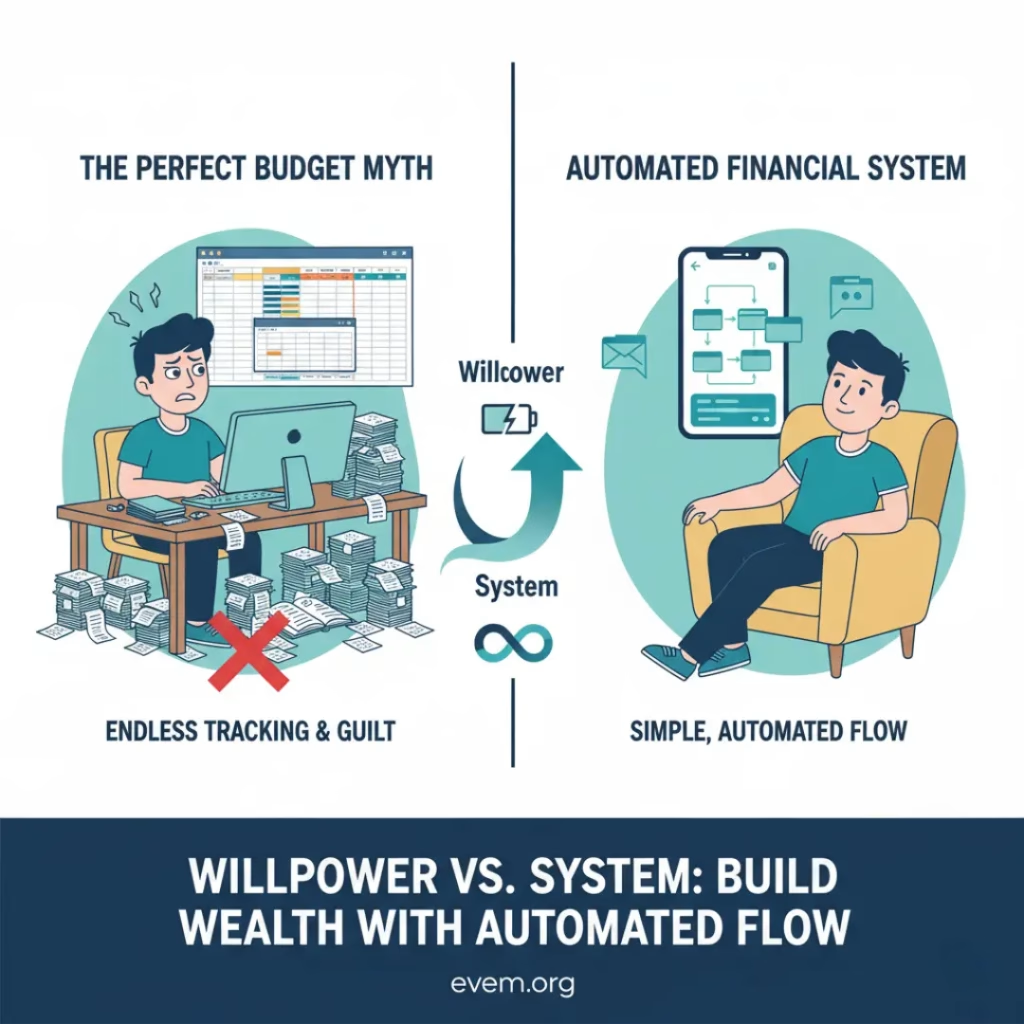

The biggest mistake I see clients make is believing they need a “perfect budget.” They spend hours tracking every single coffee, categorizing every purchase, and then feel immense guilt when they inevitably “fail.”

This is like trying to lose weight by counting every single calorie you eat. It’s exhausting, shame-inducing, and it almost never lasts. It’s why I’m a firm believer in a more flexible approach I call “Soft Saving.”

Wealth isn’t built on willpower; it’s built on systems. Your willpower is a finite resource that gets drained every time you resist a tempting purchase or force yourself to log an expense. A good system runs on autopilot, making the right financial decisions for you before you even have to think about them. This isn’t about more discipline; it’s about better design.

“Financial freedom isn’t about having a million dollars; it’s about spending $20 without a knot in your stomach because you know your future is already taken care of.”

Your 3-Step Automated Cash Flow System

This system is designed to be set up once and then run itself. Its goal is to automate your financial priorities so you can spend the rest of your money freely and without guilt. It’s the first major step in your own Financial Freedom Blueprint.

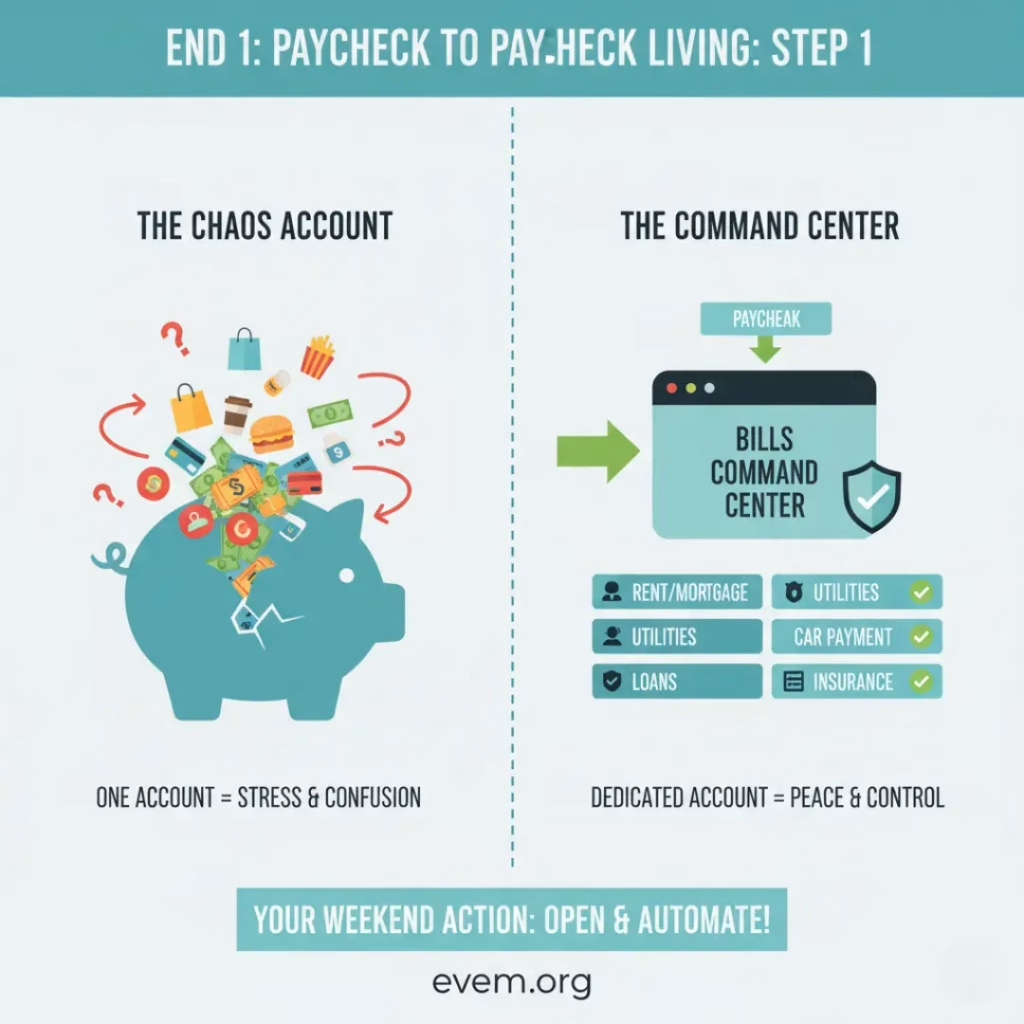

Step 1: The “Financial Triage” – Create Your Command Center Account

The first step is to stop running your entire financial life out of one chaotic checking account. You need to separate your fixed, predictable bills from your variable, everyday spending. To do this, you’ll create a dedicated “Command Center” account.

- What it is: A second, no-fee checking account at your bank or an online bank.

- Why it works: This account has one job: to receive your paycheck and automatically pay your fixed, boring, but essential bills—rent/mortgage, utilities, car payment, student loans, and insurance. By isolating these, you never have to worry if you’ll have enough for rent at the end of the month. The money is already there, waiting.

Your Weekend Action Plan: Open a new, no-fee checking account. You can do this online in about 10 minutes. Nickname it “Bills Command Center” in your banking app. Then, list every single fixed monthly bill you have and their due dates. This is the army you need to feed.

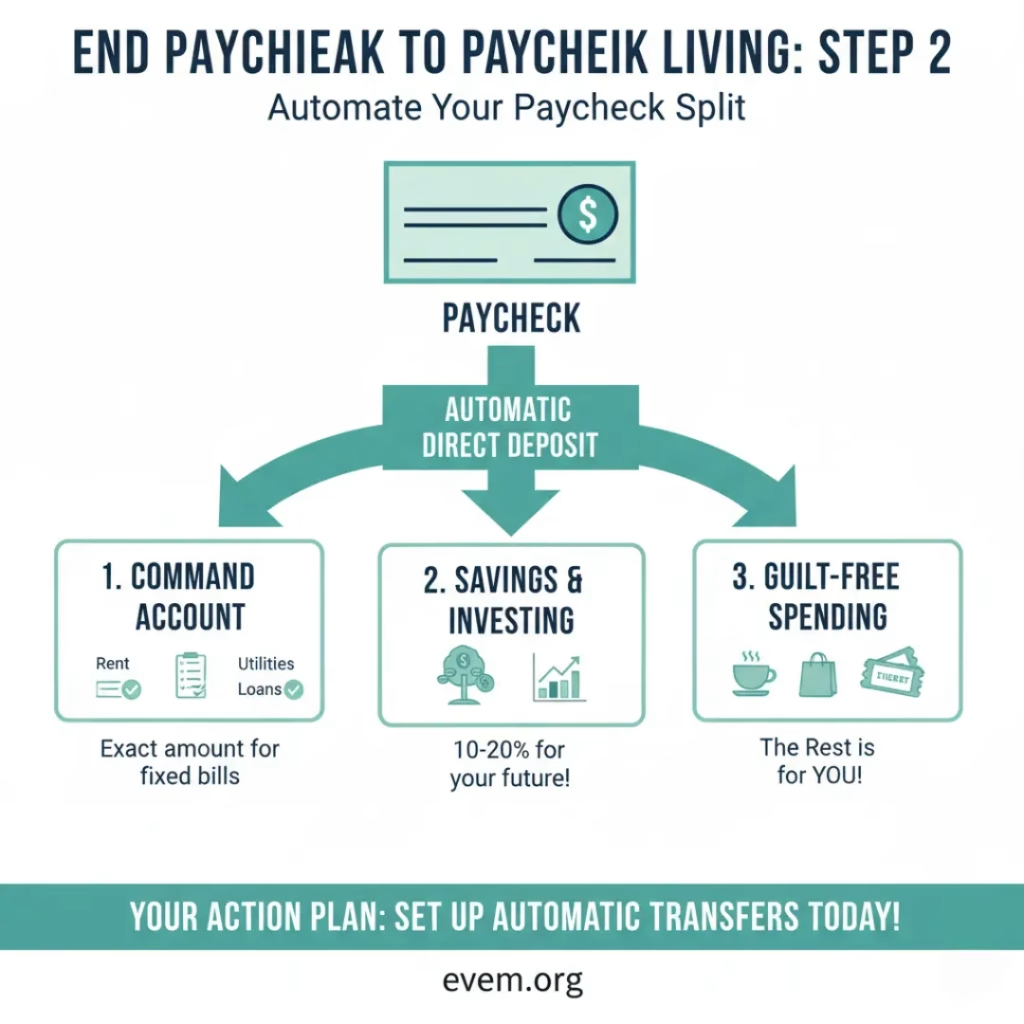

Step 2: The “Paycheck Split” – Automate Your Priorities

Now that you have your Command Center, it’s time to become the air traffic controller for your income. Instead of your whole paycheck landing in one account and hoping for the best, you’ll tell it exactly where to go.

- How it works: You’ll set up a system where your paycheck is automatically split and sent to three different destinations the moment it arrives.

- To Your “Command Center” Account: The exact amount needed to cover all your fixed monthly bills (from Step 1) goes here first.

- To Your High-Yield Savings/Investment Account: A fixed percentage (start with 10%, aim for 20% or more) goes directly to your future self. This is your wealth-building engine. If you’re nervous about starting, remember you can begin with just a small amount. The key is to conquer your fear and start investing, even if it’s just $100.

- To Your Primary Checking Account: This is the magic step. Whatever is left over after your bills and savings are handled is transferred here.

Your Action Plan: Log into your company’s payroll portal. Many allow you to split your direct deposit into multiple accounts. If not, simply set up two automatic transfers in your banking app to trigger the day after your payday: one to your savings/investment account (where you can begin your journey with simple ETF investing), and one to your “Command Center.”

Step 3: The “Guilt-Free Spending” Account – Enjoy Your Life

This is your primary checking account. And it has a new, beautiful purpose: it’s your guilt-free spending money for the pay period.

- Why it’s a game-changer: The money in this account is yours to spend on anything you want—groceries, dinners out, movies, new shoes—without a single ounce of guilt. Why? Because you know, with 100% certainty, that your rent is covered, your loans are being paid, and your savings are growing. You’ve already paid your bills and your future self. The rest is for living.

This simple system flips the script from restriction to freedom. Once your cash flow is under control, you can focus on the next level: increasing your income. Having a solid system gives you the confidence to walk into your boss’s office and negotiate your salary like a pro.

The Future is Yours to Automate

Let’s go back to Maria. After setting up this system, her financial life transformed. Her paycheck would come in, and the money would silently move to where it needed to go. She stopped checking her account with dread. The money in her main checking account became her “allowance,” and she spent it freely, knowing the important things were handled. For the first time, she felt in control.

You don’t need a finance degree. You don’t need more willpower. You just need a better system.

This weekend, take an hour. Open the second account, calculate your bills, and set up the automatic transfers. It’s the single best investment you will ever make in your financial peace of mind.

Join our email list and get access to exclusive content available only to subscribers.