Banks do it to survive crises. Now, you can do it with ChatGPT. Here is the banker’s guide to recession-proofing your investments.

In banking, we have a grim but necessary ritual. It’s called the “Stress Test.”

Before we manage billion-dollar portfolios, we don’t just hope for the best. We intentionally simulate the worst. We ask: “What happens to this money if inflation hits 8%? What if the tech sector collapses? What if unemployment spikes in 2026?”

For years, this kind of sophisticated risk analysis was locked behind Bloomberg terminals and expensive consultants. Regular investors were left to “buy and hope”—often leading to panic when the market eventually dipped.

But in late 2025, the game changed. You now have a pocket-sized financial analyst that can run these simulations for you.

If you are worried about the economy (and let’s be honest, who isn’t right now?), stop guessing. Here is how I use AI tools to “Stress Test” my personal portfolio, and how you can do the same in 10 minutes to sleep better at night.

What is a “Stress Test” (And Why Do You Need One?)

Think of your investment portfolio like a new car.

You wouldn’t drive a car that hasn’t been crash-tested, right? You want to know it can survive impact before the accident happens.

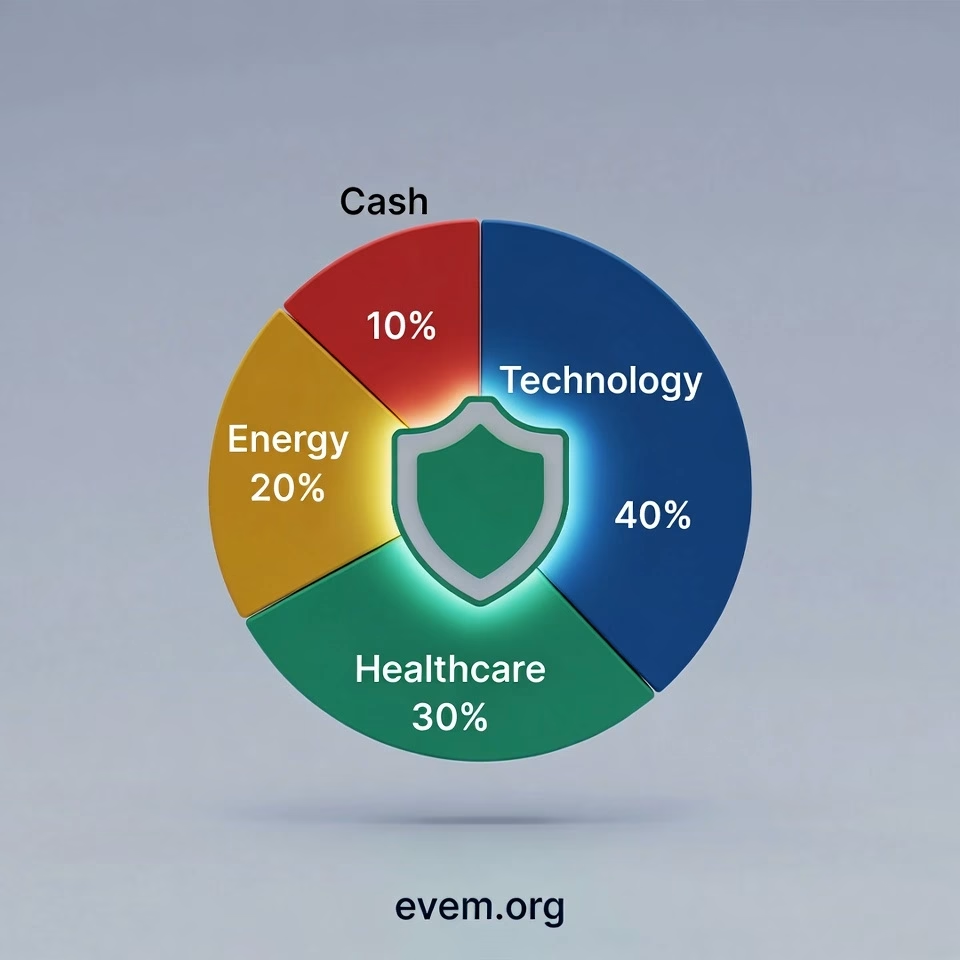

A Portfolio Stress Test is a virtual crash test. It reveals the hidden cracks in your financial foundation. Maybe you own 10 different stocks, but if they are all in the Tech sector, a single regulatory law could wipe out 40% of your wealth. A stress test screams, “Warning! You are not diversified!” before it’s too late.

The “Blind Spot” of the Modern Investor

Most of the clients I see make one fatal mistake: They mistake a “collection of stocks” for a “strategy.”

They buy a little Nvidia, some crypto, maybe an S&P 500 ETF. It looks like a lot, but they have no idea how these assets interact during a crisis. As I wrote in What If I Invest at the Absolute Worst Time?, the market will inevitably have bad days. The goal isn’t to avoid them; it’s to survive them without panic-selling.

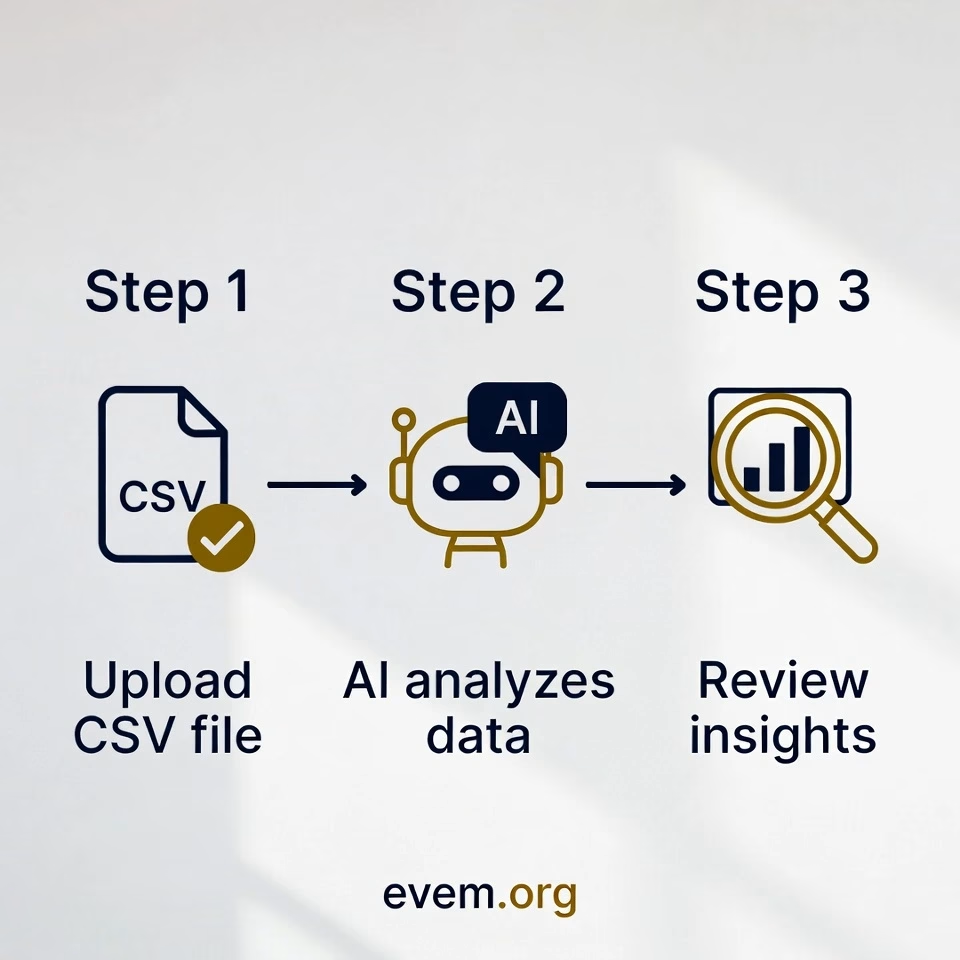

The 3-Step AI Stress Test Protocol

Here is the exact workflow I use. You can use ChatGPT (Plus), Claude, or any advanced AI model with data analysis capabilities.

(Note: We are using AI for analysis, NOT for financial advice. Never blindly follow a bot’s stock picks.)

Step 1: The “Safe Data” Dump

First, privacy is paramount. Never upload your account numbers or real name.

Export your portfolio holdings to a simple CSV or text list. It should look like this:

- Asset: VOO (S&P 500 ETF) – Allocation: 40%

- Asset: Apple (AAPL) – Allocation: 20%

- Asset: Bitcoin – Allocation: 10%

- (…and so on)

Step 2: The “Doomsday” Prompt

This is where the magic happens. We are going to ask the AI to simulate a 2026 recession scenario. Copy and paste this prompt:

“Act as a Senior Risk Manager at a major investment bank. I am providing you with my current asset allocation below. Please perform a ‘Stress Test’ on this portfolio against three specific scenarios:1. High Inflation Persistence (Inflation stays above 5% through 2026).2. Tech Sector Correction (A 20% drop in major tech stocks).3. A General Recession (Global slowdown).

For each scenario, estimate the potential drawdown (loss) percentage based on historical correlations. Also, identify my biggest ‘Concentration Risk’. Be brutally honest.”

Step 3: The Diagnosis

When I ran this for a client recently, the AI immediately flagged a massive risk: “90% of your portfolio is dependent on the US Tech sector. If Tech sneezes, you catch pneumonia.”

The client thought he was diversified because he owned 15 different stocks. The AI showed him they were all moving in the same direction.

This insight is priceless. It allows you to rebalance before the crash.

How to Fix the Cracks (The Banker’s Prescription)

If your stress test comes back bleeding red, don’t panic. This is good news. You found the problem while you can still fix it.

1. Diversify with ETFs:

If the AI says you are too exposed to one company or sector, the solution is usually to broaden your base. This is exactly why I recommend ETF Investing for Beginners. ETFs allow you to own the entire haystack instead of looking for the needle, instantly reducing that concentration risk.

2. Check Your Cash Buffer:

If a stress test shows a potential 30% drop in your portfolio, ask yourself: “Can I handle that mentally?” If not, you might be investing money you need too soon. Ensure your Financial Freedom Blueprint includes a solid emergency fund so you never have to sell stocks at a loss to pay bills.

3. Don’t Trust; Verify:

Remember my warning in The AI Money Trap: AI can hallucinate. Use these results as a “second opinion” to challenge your assumptions, but verify the data with trusted financial news sources or a human advisor.

The Bottom Line

In banking, we have a saying: “Risk comes from not knowing what you are doing.”

A stress test removes the unknown. It turns the boogeyman of a “2026 Recession” into a math problem. And math problems can be solved.

You don’t need to predict the future to be prepared for it. Use the tools available in 2025 to audit your own portfolio. If you find cracks, fix them now. If you pass the test, you can close your eyes and sleep soundly, knowing your wealth is built to withstand the storm.

Want the exact prompt templates I use for different risk scenarios?

Join our email list to get my “AI Investment Toolkit” PDF, exclusively for subscribers.