I have a confession: I hate budgeting.

Even as a banker who has managed millions of dollars for clients since 2010, I find the traditional advice of “write down every coffee you buy” incredibly boring. It feels like a punishment. If you are like me and prefer a more flexible approach, you might already be practicing “Soft Saving”.

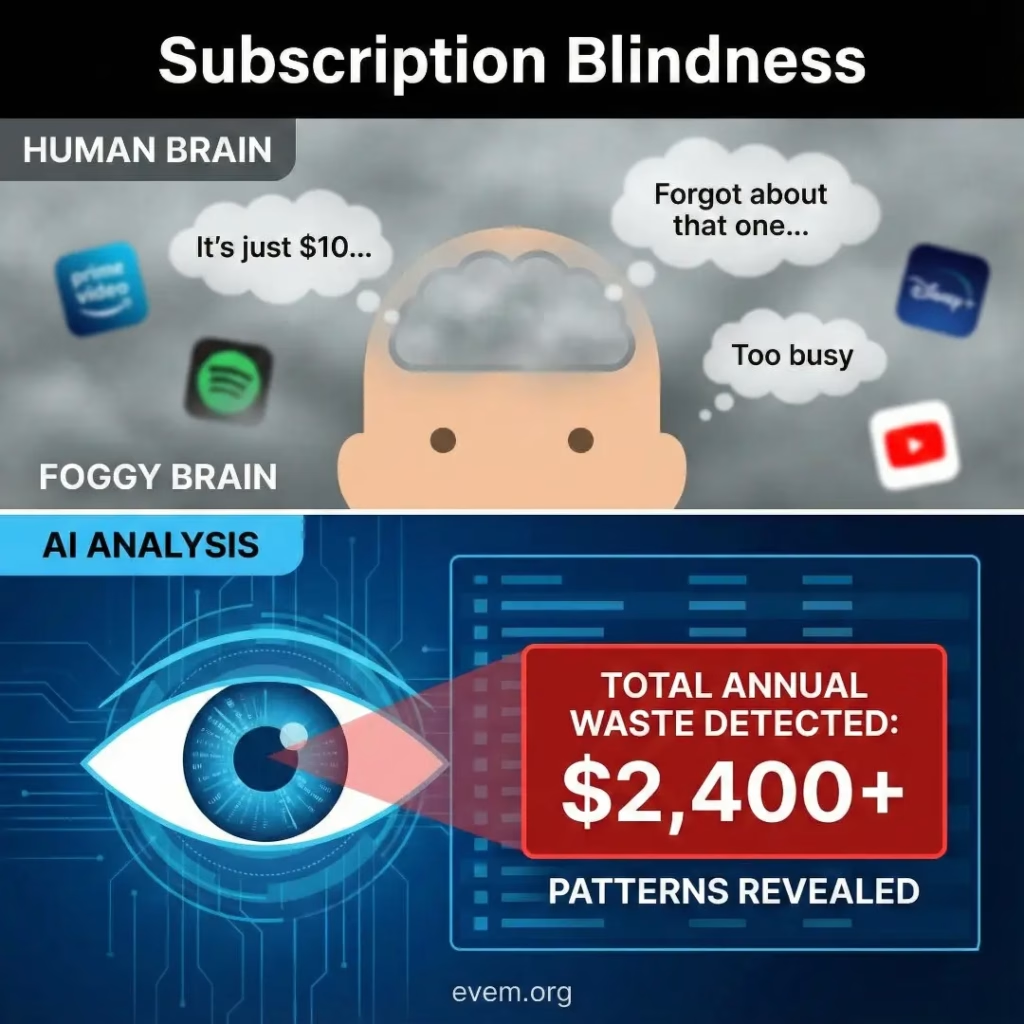

But regardless of your style, there is a hidden problem lurking in your bank account right now. Most people think the only way to save money is to suffer—to cut out the things you love. But what if I told you that you are likely bleeding money right now on things you don’t love? Things you don’t even know exist?

In the corporate banking world, when a company is losing money, we don’t tell them to stop buying coffee. We perform a “Forensic Audit.” We dig into the data to find the leaks, the errors, and the waste.

Last weekend, I treated my personal finances like a client’s business. But instead of spending hours with a calculator, I fed my bank statement into ChatGPT with a specific prompt (which I’ll share below), and in 30 seconds, it found $200 a month in wasted spending. That is $2,400 a year of found money.

Here is exactly how I did it.

Why Your Brain Can’t See the Leaks (But AI Can)

We all suffer from “Subscription Blindness.” In 2025, everything is a subscription. Your brain filters these small charges out as “background noise.” But to an AI, there is no background noise. It sees patterns.

In a previous article, I warned about The AI Money Trap and why you should never trust a chatbot to make decisions for you. However, while AI is a terrible decision maker, it is an excellent data analyst. This is the safe way to use the technology.

The Safety First Warning (Read This Before You Start)

As a banker, privacy is my number one rule. Never upload your raw bank statement with sensitive info to a public AI chatbot.

The “Sanitization Protocol”:

- Download your transaction history (CSV/Excel) for the last 3-6 months.

- Delete columns with Account Number, Name, and Address.

- Keep only: Date, Description, and Amount.

- Now it is safe to copy and paste.

The Step-by-Step Guide to Finding Your “Lost” Money

Step 1: The Setup

Open ChatGPT (or Claude/Gemini). Copy your sanitized transaction list to your clipboard.

Step 2: The Magic Prompt

Copy and paste this prompt:

“Act as a ruthless Forensic Accountant. I am going to paste my transaction history below. Analyze it and look for three specific things:

1. Zombie Subscriptions: Identify recurring payments happening on the same day each month.2. The “Inflation Creep”: Identify recurring bills (utilities, insurance) that have increased in price over the last 6 months.3. The Waste: Flag duplicate charges or unusual fees.

Present your findings in a table with the potential annual savings. Here is the data: [PASTE YOUR DATA HERE]”

Step 3: The Audit

When I did this, the AI found:

- A “Free” VPN trial ($12.99/mo).

- Duplicate Cloud Storage ($9.99/mo).

- Insurance Creep ($22/mo increase).

- A “Zombie” Gym Membership ($29.99/mo).

Total Monthly Waste: $200+

What To Do With Your “Found” Money

Congratulations! You found $2,400. Do not spend this money. You need to give this money a job immediately.

Option A: Crush Debt

If you have credit card debt, this found money is your ammunition. Use it to attack your debt using the strategy I outlined in The High-Interest Trap.

Option B: Start Investing

If you are debt-free, this $200 is your seed capital. You don’t need thousands to start. As I explained in From Spare Change to a Small Fortune, consistent small amounts are the key to wealth.

By redirecting this waste into your Financial Freedom Blueprint, that $200/month invested at 8% turns into over $270,000 in 30 years.

Stop trying to budget with willpower. Start auditing with intelligence.

Join our email list and get access to exclusive content available only to subscribers.