The notification popped up on a Tuesday. A soul-crushing, blood-red -42% next to the biggest bet in my portfolio. It wasn’t a market crash; it was a personal one. A speculative tech stock I’d poured a dangerously large chunk of my bonus into had just imploded after a disastrous earnings call. The number wasn’t abstract. It was a six-figure mistake. My mistake.

My first instinct wasn’t rational. It was a visceral, gut-punch of shame, regret, and pure panic. My brain, the same one I used to analyze billion-dollar deals at the bank, was screaming a single, primal word: SELL. Sell what’s left, save yourself, hide the evidence.

If you’re reading this, chances are you know this feeling. Maybe you lost money on a crypto coin that went to zero, a meme stock that evaporated, or an ETF you panic-sold at the bottom. The question roaring in your head is likely, “I lost a lot of money in the stock market, what should I do now?”

This is your step-by-step playbook to recover.

Before we dive deep, you can watch the core concepts of this debate explained in this 2-minute summary:

In our popular article, “The Market Is Tanking. Here’s Your Banker’s ‘Do Not Panic’ Guide” we covered the crucial strategy for preventing a financial wound by holding on during a downturn. This article is different. This is your first-aid kit for after the wound is real.

After nearly 20 years in banking, I’ve seen this pattern in every market cycle. The principles of recovering from a loss haven’t changed, but the emotional speed of it in today’s world has. Here is the playbook I’ve used myself and shared with countless clients to turn a devastating loss into the most valuable lesson you’ll ever learn.

Step 1: Diagnose the Damage (Without the Blame)

The moment after a big loss, your brain is a crime scene of emotions. The first step isn’t to act; it’s to become a detective. You need to perform a financial post-mortem with one critical rule: no shame, no blame, just data. Shame makes you hide; objective analysis makes you richer.

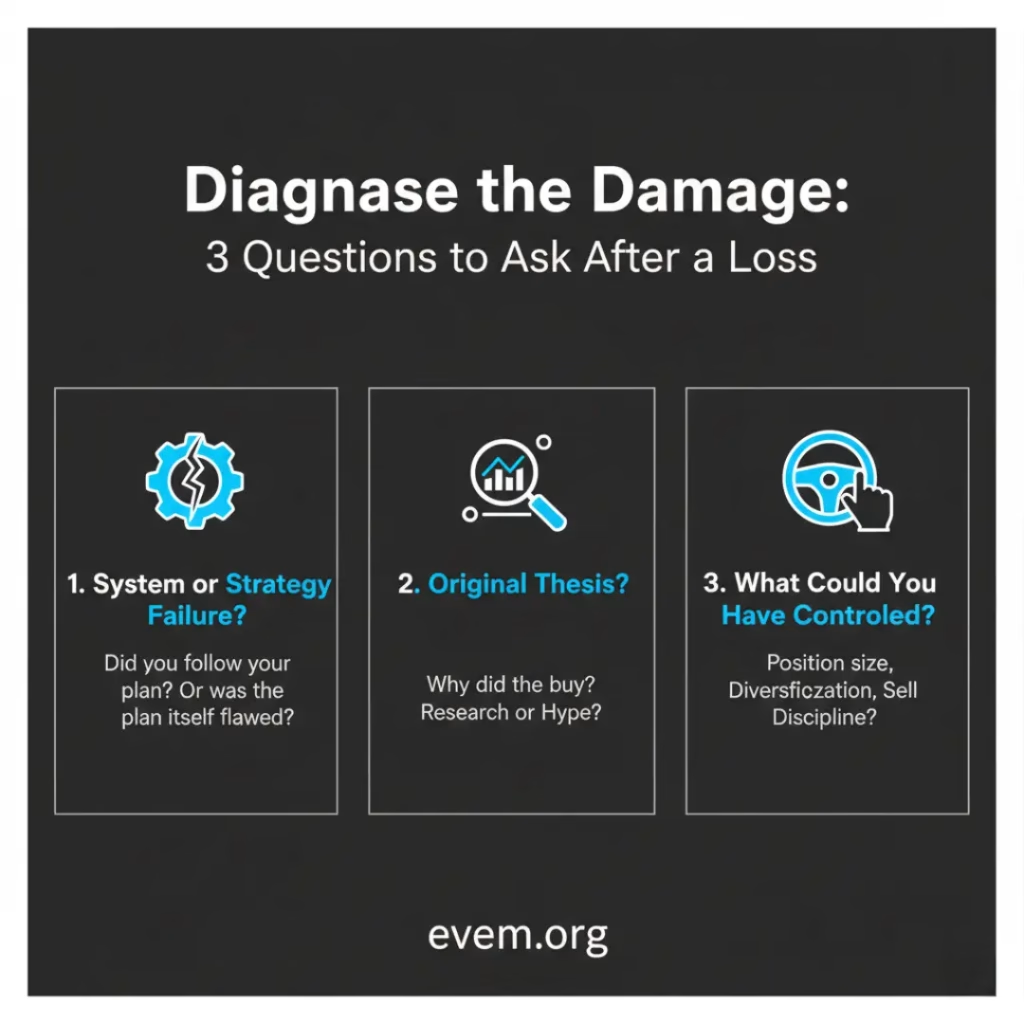

Ask These 3 Questions to Understand What Went Wrong:

- Was it a System or Strategy Failure? Did you have a clear plan (like a stop-loss) and failed to follow it? That’s a system failure—an emotional mistake. Or was your strategy flawed from the start (e.g., “I’m putting 50% of my net worth into one risky stock”)? That’s a strategy failure.

- What Was Your Original Thesis? Why did you buy it? Was it a well-researched bet, or was it because you saw it on social media? Be brutally honest. My six-figure mistake came from getting swept up in hype and ignoring my own research.

- What Could You Have Controlled? You can’t control the market. You can control your position sizing, your diversification, and your sell discipline. Pinpoint the exact moment you lost control.

“A financial plan that lets you sleep at night is always more profitable than a ‘perfect’ one that has you constantly checking your phone in a panic.”

Step 2: Rebuild Your Confidence with a ‘System Reboot’

After a big loss, your financial account takes a hit, but your confidence account is near bankruptcy. Your instinct is to retreat from the market entirely. As we discussed in “What If I Invest at the Absolute Worst Time?” the cost of staying on the sidelines is almost always higher than the risk of investing.

You need to get back in the game, but the goal isn’t to immediately make your money back; it’s to score a small, confidence-building win.

Your Action Plan: Take a small, almost laughably insignificant amount of money—$50 or $100—and invest it in the most boring, sensible asset you can think of. A broad-market, low-cost index fund ETF (like VOO or VTI) is perfect.

This action does two critical psychological things:

- It replaces the painful memory of your last investment (a loss) with a new, positive action.

- It shifts your identity from “someone who lost money” back to “someone who is an investor.”

This isn’t a financial move; it’s a psychological one. You’re repairing your mindset.

Step 3: Triage Your Portfolio: What to Keep, What to Cut

Now, with a clearer head, it’s time to deal with the rest of your portfolio. It’s time for triage.

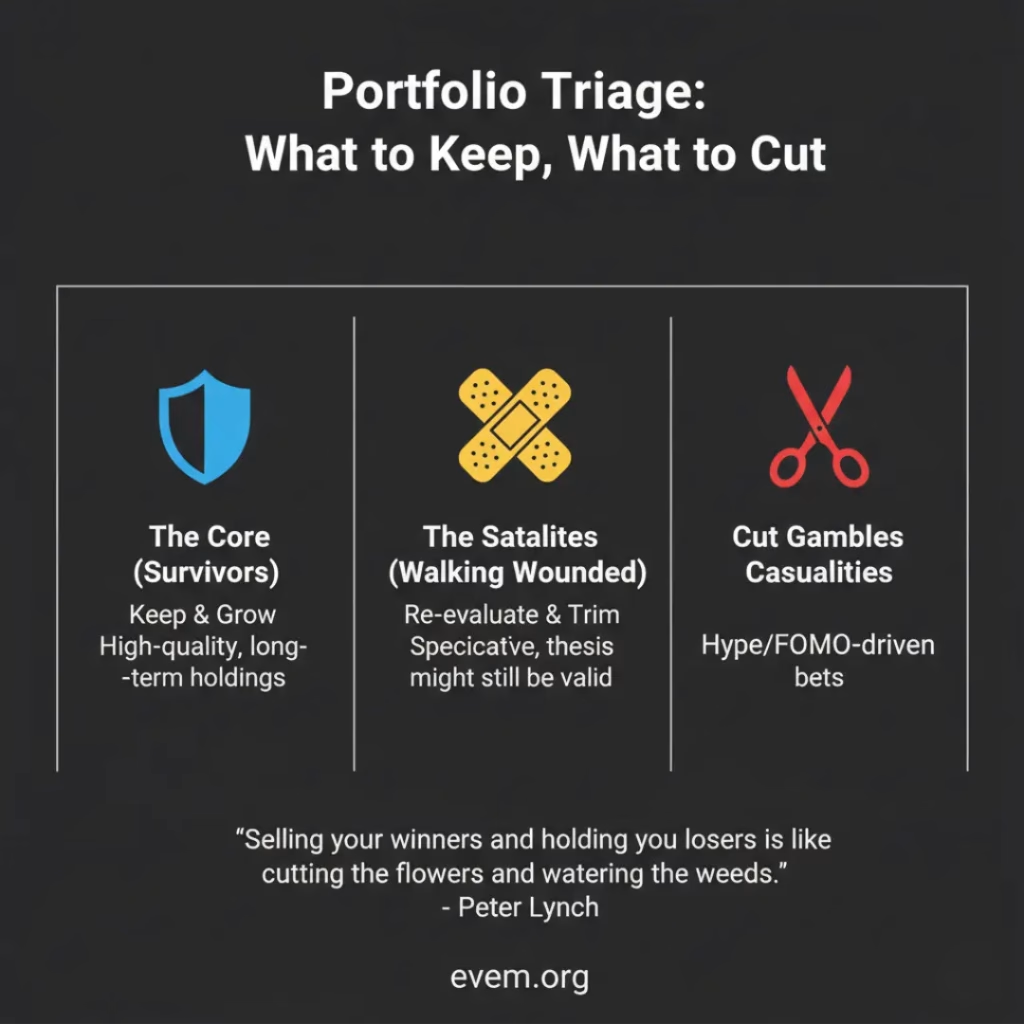

How to Categorize Your Remaining Assets:

- The Core (Survivors): Your high-quality, long-term holdings (diversified ETFs, blue-chip stocks). Action: Do nothing. Let them work.

- The Satellites (Walking Wounded): Speculative bets that are down but not out. The thesis might still be valid. Action: Re-evaluate. If your conviction is gone, plan to trim the position to reduce risk.

- The Gambles (Casualties): Investments you made based on hype or FOMO. Action: Be ruthless. These are weeds in your financial garden. Create a plan to sell them, even at a loss, to free up capital for your core strategy.

As the legendary investor Peter Lynch said, “Selling your winners and holding your losers is like cutting the flowers and watering the weeds.” A major loss is the perfect catalyst to finally pull those weeds.

Step 4: Write It Down: Forge Your New Investing Rules

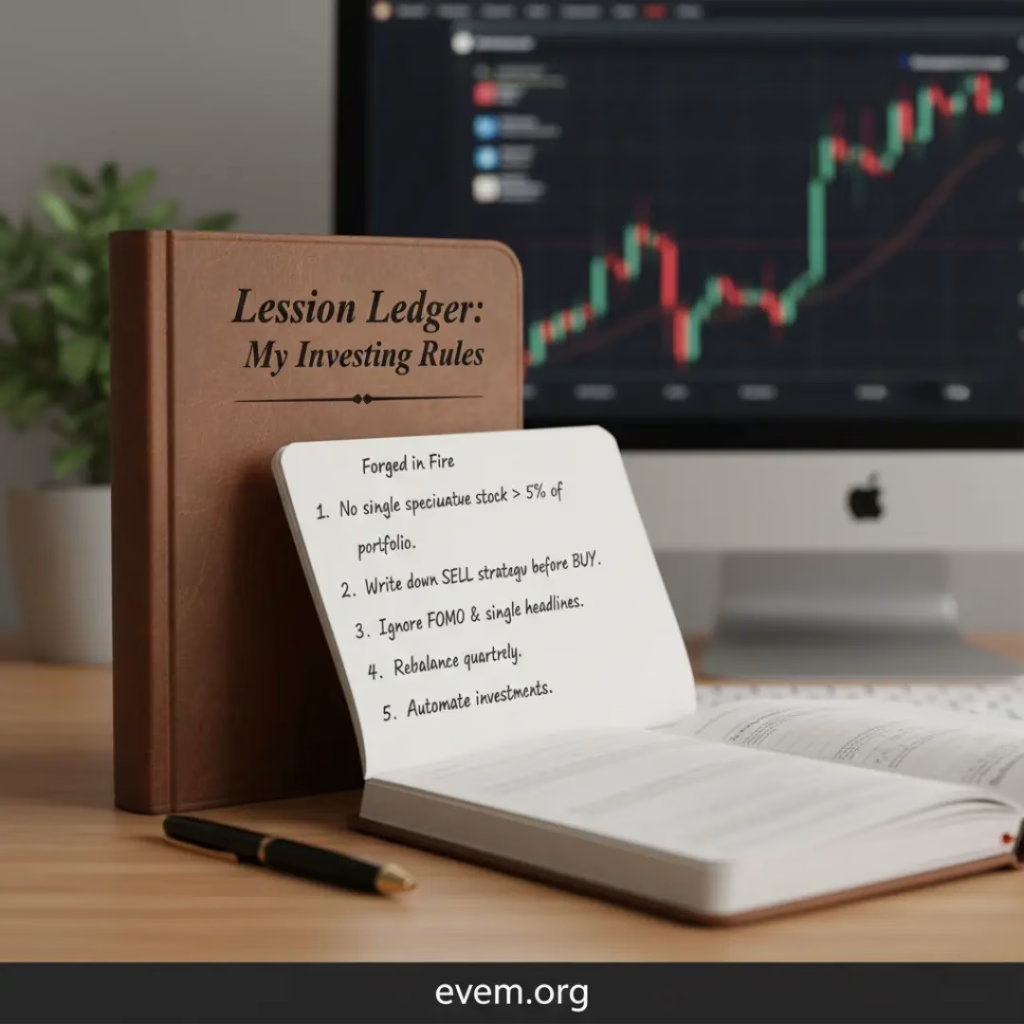

Your loss is an expensive tuition payment. It’s time to collect your degree. Create a document called your “Lesson Ledger.” On it, write your new, unbreakable rules of investing, forged in the fire of this mistake.

These are not vague goals; they are specific commands. My ledger, written after that six-figure loss, includes rules like:

- “No single speculative stock will ever exceed 5% of my total portfolio.”

- “I will write down my sell-strategy before I ever click the ‘Buy’ button.”

- “I will not make investment decisions based on a single news headline or social media post.”

This ledger becomes your personal investing constitution. The next time you feel the pull of hype, read it.

“Your most expensive mistakes are the only financial advice you will never forget. Write it down.”

Step 5: Automate Your Recovery and Embrace ‘Boring’

You’ve diagnosed the problem, rebuilt your confidence, triaged your portfolio, and written your rules. Now, put your recovery on autopilot. This is where you embrace the beautiful, wealth-building power of being boring.

Go back to the basics we outline in “The Financial Freedom Blueprint.” Your primary focus now is to aggressively and automatically fund your Core portfolio.

- Increase Your Automatic Contributions: If you were investing $500 a month, can you make it $600? Redirect the capital from your sold “Gambles” here.

- Embrace Dollar-Cost Averaging: Your consistent, automated investments are the single best way to remove emotion and systematically build wealth over time.

Losing big money feels like a failure. But I can tell you from nearly 20 years of experience, it’s a rite of passage. Every successful investor I know has a story like this. It’s the scar tissue that makes you stronger. My six-figure mistake was painful, but the lessons I learned from it have made me millions since.

Welcome to the club. Now, let’s get back to building.

Join our email list and get access to exclusive content available only to subscribers.